How to Create a Net Worth Tracker in Excel

Nowadays, we really need to keep an eye on our assets and liabilities to really be informed on our financial status—it isn’t enough to just track income and expenses! Which is why you need a net worth tracker, a template specifically made for monitoring and tracking your assets and liabilities. This tracker should inform any and all financial choices that you make as it essentially lists what you are monetarily capable of.

Making a net worth tracker in Excel is simple! And with this step-by-step guide with instructions that anyone can follow, you can create your own net worth tracker template that fits your needs. We’ve also got additional tips and tricks sprinkled in there that can help you in further optimizing your tracker!

Why You Need a Net Worth Tracker? 💰

Here are several reasons why having a personal net worth tracker is important:

- Gives you a snapshot of your current financial situation and helps you monitor any changes that may appear over time.

- Measures your progress toward particular goals like buying a house or a car.

- Seeing your net worth in an upclimb can act as motivation to continue saving, investing, and reducing debt.

- Acts as a reference material in making heavyweight choices when it comes to money, investments, and risks.

💻 Step-by-Step Guide to Creating a Net Worth Template in Excel

Step 1: Open Microsoft Excel and Set Up Your Workbook

To create your net worth tracker spreadsheet, start by creating a new workbook in Excel and naming it something obvious, like "Net Worth Tracker" or "Your Name Net Worth Tracker."

Step 2: Create the Header Section

Your net worth tracker's header section should be created first. This will contain the document's title, like "Personal Net Worth Tracker," as well as the date range, like "As of [Month, Year]". You can also briefly describe your net worth tracking objectives in this section.

This header section will serve as an overview of your financial situation, which you can update regularly.

Step 3: Categorize Your Assets and Liabilities

Sorting your money into several categories is the next stage. The two primary components that you will want are Assets and Liabilities.

Assets Section:

Assets include things, like your house, vehicles, etc., that you can sell for cash. You should include the following typical asset categories in your net worth calculator spreadsheet:

- Liquid Assets (includes savings and checking accounts, etc.)

- Investments (includes stocks and bonds, etc.)

- Real Estate (these are properties or land)

- Personal Property (includes rings, gold necklaces, cars, etc.)

Liabilities Section:

Liabilities are obligations or debts that affect your net worth like loans, mortgages, etc.. They can usually be divided into the time it takes to pay it completely:

- Short-term Liabilities

- Long-term Liabilities

Step 4: Calculate Your Net Worth

The next step involves finally calculating your personal net worth. After compiling all of the information previously asked for, you can now input it in your created template. The formula for net worth is simply subtraction. The following formula in Excel makes this computation simple to complete:

= Total Assets - Total Liabilities

For example, if your Total Assets are $257,000 and your Total Liabilities are $180,000, your net worth will be:

Net Worth = $257,000 - $180,000 = $77,000

You can use Excel’s built-in SUM() function to calculate the totals for both assets and liabilities. For example:

- Total Assets formula: =SUM(B2:B6)

- Total Liabilities formula: =SUM(D2:D5)

Step 5: Add Additional Information

You can add more details to your net worth tracker Excel to make it more comprehensive. For example:

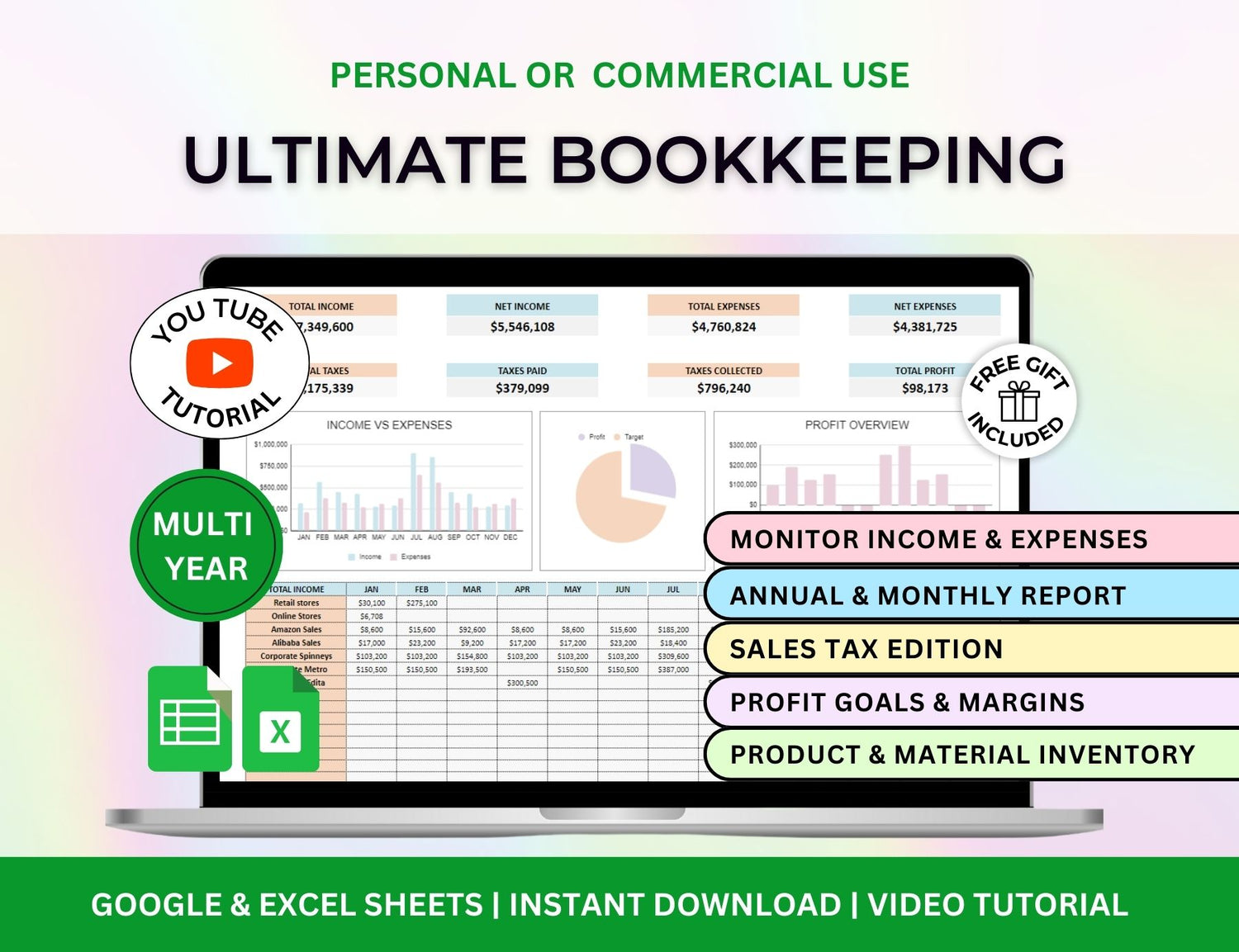

- Growth Over Time: This is essentially a month-by-month or year-by-year summary in table form you can create in your spreadsheet.

- Charts and Graphs: This gives you a picture on how your progress looks over time with a single glance. Line graphs, bar graphs, and pie charts are included here.

To create a simple graph:

- Select the data you want to visualize.

- Click on Insert → Charts and choose the type of chart (e.g., pie chart, bar chart).

- Adjust the chart’s title and labels for clarity.

Step 6: Use Excel Formulas for Automation

Using formulas in your net worth tracker spreadsheet can save time and reduce errors. Here are some useful formulas:

-

SUM(): To add up assets and liabilities.

- Example: =SUM(B2:B6) to sum the asset values.

- Example: =SUM(B2:B6) to sum the asset values.

- IF(): To display text when certain conditions are met. For example, to show whether your net worth is positive or negative:

-

=IF(C10 > 0, "Positive Net Worth", "Negative Net Worth")

- Conditional Formatting: To emphasize certain values in your tracker like say, a total turns negative then it turning red puts a certain focus on it and calls for your attention.

- Conditional Formatting: To emphasize certain values in your tracker like say, a total turns negative then it turning red puts a certain focus on it and calls for your attention.

Step 7: Save, Update, and Review Regularly

The efficacy of an Excel net worth tracker depends on how frequently it is updated. Every month, schedule time to update your net worth tracker template to reflect any modifications to your assets and liabilities. You can also look at your progress throughout the course of the year to see how your net worth changes.

Step 8: Customize Your Net Worth Tracker

To suit your own financial circumstances, feel free to modify your personal net worth tracker. To improve the usefulness of your tracker, add or remove categories as necessary and play around with Excel's many capabilities (including pivot tables and dynamic charts).

⚖️ Excel-Related Queries on Net Worth Trackers

1. Does Excel have a net worth template?

╰┈➤ˎˊ˗ Unfortunately, it does not! However, you can use it as a digital tool to create one. This starts by listing and compiling all of your assets (this is everything you own!) and all your liabilities (the amount you owe). Once you’ve compiled all of this information, you can follow the guide in this article to create and customize your own tracker. The article goes in-depth with simple-written instructions that anyone can follow!

2. How to track net wealth?

╰┈➤ˎˊ˗ You can do it through various means but one we recommend is by doing it through a template in Excel! You can do this through collecting all of your assets (this includes savings!) and liabilities (this includes your credit card!) and placing this information in a single document that you can update and monitor. Excel then has features and formulas you can use to calculate your overall net worth. If you need any assistance on what formula to use or if you want to create your own template, this article is essentially a tutorial to make just that!

3. Is Excel good for tracking finances?

╰┈➤ˎˊ˗ Indeed, Excel is a great tool for managing your money. It gives you the freedom to design trackers that are tailored to your own requirements. You can use conditional formatting, charts, and formulas to keep track of your investments, debts, income, and expenses. Simple updates, data analysis, and financial progress visualization are made possible by Excel's robust features. For both novice and expert users seeking to improve their financial management, it's a flexible tool.

4. How do I track assets in Excel?

╰┈➤ˎˊ˗ Make a table in Excel containing columns for the asset name, category (such as cash, real estate, or investments), and current value in order to track assets. If appropriate, you can also include columns for the purchase date and depreciation. You can then use any formula available for use in Excel to calculate the sum of all of your assets—a plus is that these formulas calculate any updated data automatically! Meaning you don’t have to be so meticulous!

🔎Frequently Asked Questions (FAQs)

1. How often should I update my net worth tracker?

╰┈➤ˎˊ˗ Your net worth tracker template should be updated at least once every month. You can better monitor developments in your financial status, such as shifts in your investments or the addition of new debt, by receiving regular updates.

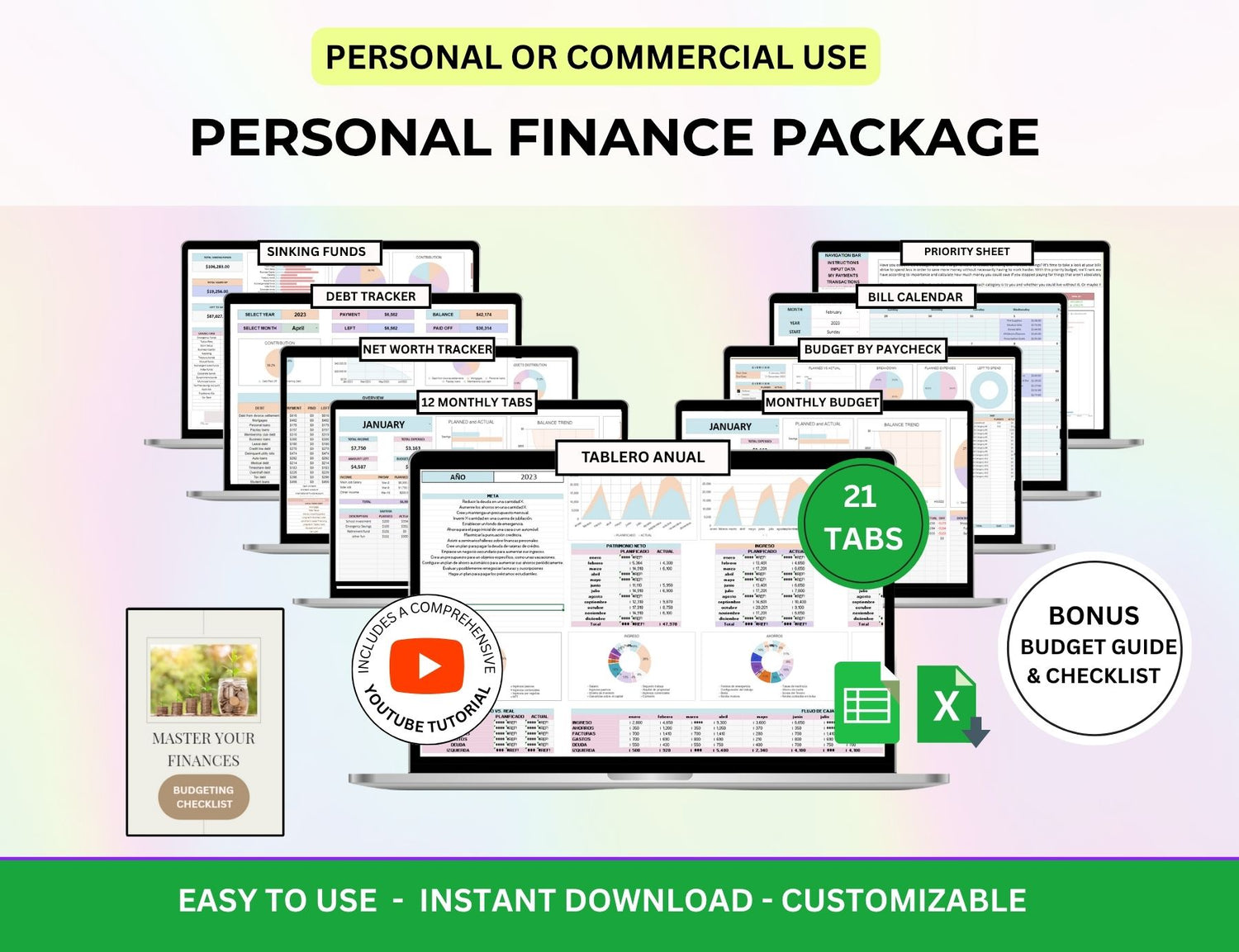

2. How can I track my net worth over time?

╰┈➤ˎˊ˗ You may keep track of your net worth over time by noting your total assets and liabilities in a column for each month. A chart that illustrates the evolution of your net worth over a given time frame can also be made.

3. Can I track my investments in the net worth tracker?

╰┈➤ˎˊ˗ True! Your tracker's Assets section allows you to add investments like stocks, bonds, and retirement accounts. Make sure to periodically update these investments' values to account for shifts in the market.

4. How do I calculate the value of my real estate?

╰┈➤ˎˊ˗ You can do this by researching your real estate on online property tools or through appraisal—although, it is to be noted that one would be more accurate than the other. If you want the most accurate estimate, a professional evaluation or a real estate agent with market knowledge will provide this.

5. How can I ensure my tracker is accurate?

╰┈➤ˎˊ˗ It is important to ensure that your net worth tracker Excel is up to date with the latest details on all of your assets and liabilities. Make sure the numbers are accurate by double-checking items like asset values and outstanding obligations.

6. Can I use this tracker for different currencies?

╰┈➤ˎˊ˗ It is possible to monitor net worth in multiple currencies. For an accurate total computation, make sure to translate any assets or liabilities that are in several currencies into a single currency. For this, you can leverage external data sources or Excel's currency conversion features.

This blog will show you how to make a net worth tracker spreadsheet that will help you in your financial journey—not only through the recording and monitoring of your assets and liabilities but also through helping you make grounded choices that will advance your financial future.

You may monitor your progress, make wise financial decisions, and maintain your motivation to meet your financial objectives by routinely updating your basic net worth tracker. Take charge of your financial destiny by creating your net worth tracker Excel now!